China's president is expected to pledge billions of dollars in investments for India this week as Beijing looks to gain influence with a regional heavyweight at a time when Asia's balance of power is in flux.

During a three-day trip to India, Xi Jinping will meet Indian Prime Minister Narendra Modi and lay the groundwork for a wave of Chinese money to build industrial parks and bullet trains in a country hungry for development.

Underlying China's sharply rising interest in its neighbour is a fear that India could tilt too far toward Beijing's rivals, namely Japan and the U.S., both of which have been courting India's new government.

"China doesn't want to lose India," said Kanti Prasad Bajpai, a professor of Asian studies at the National University of Singapore. "It sees both an economic opportunity and a geopolitical incentive in engaging India at this point."

India is wary of China. The two countries fought a 1962 war and their Himalayan border remains in dispute. Last year, New Delhi accused Chinese troops of making a weekslong incursion. Beijing denied its soldiers had crossed into Indian territory.

At the same time, New Delhi needs money to achieve Mr. Modi's goals of improving the country's infrastructure, building a manufacturing base and making the world's second-most-populous country more prosperous.

For now, Mr. Modi seems content to glean what benefits he can from the strategic competition among China, Japan and the U.S. And he is not averse to playing them off against each other to bag sweeter deals for India.

The Indian prime minister has a warm personal relationship with Japanese Prime Minister Shinzo Abe. During a recent visit, the two greeted each other with a bear hug, agreed to increase defense cooperation and vowed to build a "special" strategic partnership to shape the 21st century.

In Tokyo, Mr. Modi took a swipe at Beijing, criticizing what he called an "expansionist mind-set" that leads to "encroaching on another country, intruding in others' waters."

Mr. Modi returned from Tokyo with a promise of US$35 billion in investment over five years.

Shortly after Mr. Xi leaves, Mr. Modi is scheduled to dine in Washington with President Barack Obama, and discuss deeper defence and energy ties with the U.S.

"China tends to be more amenable...to Indian interests when India moves closer to its rivals," Shyam Saran, a former diplomat and China specialist, said recently. "Its pressures on India mount when India is seen to have fewer options."

India has participated in naval exercises with Japan and the U.S. It is also strengthening ties with other Asian countries, including Vietnam, with which it agreed this week to expand cooperation in oil and gas exploration in the contested waters of the South China Sea, defying Chinese warnings.

Mr. Modi has also announced plans to ramp up investments in border infrastructure to improve military logistics. An extensive road network on the Chinese side has given Chinese troops an edge.

In a glimpse of the unresolved challenges the two sides face, Indian authorities said Monday that Chinese civilians and soldiers disrupted construction of a canal in the Himalayan region of Ladakh.

Simrandeep Singh, a senior official there, said around 50 Chinese troops and 120 civilians protested, raising banners that said: "This is Chinese territory." Mr. Singh said work on the canal has stopped "because we didn't want tensions to rise."

Deep-seated political anxiety has torpedoed Chinese investments in India in the past. Indian officials have tended to view such deals with skepticism and see Chinese companies as possible fronts for espionage operations.

Even cheerleaders of Chinese money are quick to emphasize that India must safeguard its national security interests. India could accept Chinese high-speed trains, they say, but not Chinese railroad signaling systems.

"We should draw clear red lines as to where they can come in and where they can't," said Jayadeva Ranade, the president of the New Delhi-based Center for China Analysis and Strategy.

India is evolving a two-track China policy by which it opens its doors to Chinese money, stepping closer into its economic orbit, while boosting military preparedness and strategic partnerships to cope with Beijing's rise.

Indian officials want Chinese companies to set up factories in India to manufacture products for Indian consumers as well as for export to help narrow the country's US$30 billion-plus trade deficit.

China is India's largest trading partner, with bilateral trade at US$66 billion. Most of that value is Chinese exports, including power and telecommunications equipment, to India. India's main exports to China are raw materials.

India is also keen for Chinese investment, especially in infrastructure. Chinese direct investment in India, which totals about US$400 million, trails far behind US$16 billion in cumulative investments from Japan.

Mr. Xi is expected to announce an investment of US$5 billion in two industrial parks--one in Mr. Modi's home state of Gujarat and another in the neighboring state of Maharashtra. The two sides may also firm up deals for bullet trains.

"We believe that during this visit, the Chinese and Indian relationship of the last 50 to 60 years will see a directional change," India's trade minister Nirmala Sitharaman said last week. "Despite being neighbors, we have not been able to move forward on a number of opportunities."

At a summit in July of Brics nations--Brazil, Russia, India, China, and South Africa--India signed on to China's proposal for the group's new development bank to be headquartered in Shanghai.

India is also likely to join the China-led Asian Infrastructure Investment Bank, which Beijing has proposed as an alternative to the Japan and U.S.-controlled Asian Development Bank, to help meet its multibillion dollar infrastructure-financing needs.

Indian officials say they are working to address concerns about China's control over the multilateral bank.

Mr. Modi "will go the extra mile on economic issues," Mr. Bajpai of the National University of Singapore said. "But he will also be more blunt and strong on India's differences with China."

China set to step up investment in India

China FDI falls to four year low in August

Foreign direct investment (FDI) into China dropped to a four year low in August, according to figures released by the Ministry of Commerce on Tuesday.

FDI -- which excludes investment in financial sectors -- fell 14 per cent in the month to $US7.2 billion ($A7.97 billion), the commerce ministry said.

FDI in the eight months since January fell 1.8 per cent on year to US$78.34 billion ($A86.74).

The Chinese government has previously denied any link between Beijing's multiple probes into foreign companies and falls in FDI.

A recent string of anti-monopoly investigations into foreign firms have led to complaints from the European and US business chambers that their members are being unfairly targeted.

Australian companies have been spared scrutiny so far.

US Treasury Secretary Jacob Lew has issued a letter to Chinese Vice Premier Wang Yang warning the investigations could have serious implications for relations between the two countries.

Last week Chinese Premier Li Keqiang denied the laws were being used to unfairly target foreign companies.

Foreign companies accounted for only 10 per cent of antimonopoly cases, the premier told a group of business leaders ahead of the Summer Davos forum.

Author

Quick Summary

Associated image

Media

Categories

Primary category

Status

Content Channel

China's overseas investment soars

China's outbound investment more than doubled year-on-year in August to $US12.62 billion ($A13.65 billion), data shows, far outstripping foreign direct investment (FDI) into the country, which dropped to a new multi-year low.

China has been actively acquiring foreign assets, particularly energy and resources, to power its economy.

Beijing has encouraged companies to "go out" and make overseas acquisitions to gain market access and international experience, and officials have said overseas direct investment (ODI) could exceed FDI this year.

The 112.1 per cent increase in ODI announced by the commerce ministry was a dramatic contrast to the 14.0 per cent year-on-year fall in FDI, which dropped to $7.20 billion.

Both sets of figures exclude investment in financial sectors.

FDI was also less than July's $US7.81 billion, which was the lowest since July 2012.

Commerce ministry spokesman Shen Danyang denied any link to Beijing's multiple probes into foreign companies.

Chinese authorities have in recent months launched anti-monopoly, pricing and other inquiries into scores of foreign firms in sectors ranging from auto manufacturing and pharmaceuticals to baby milk.

The investigations have raised concerns among investors that Beijing is targeting overseas companies.

But Shen denied any connection between the investigations and the fall in FDI. "They are not related," he said, declining to comment further.

For the first eight months of the year, China's ODI was up 15.3 per cent to $65.17 billion.

In that period, investment into the EU soared by 257.1 per cent, leaped 116.7 per cent into Japan, and jumped 73.3 per cent into Russia, the ministry said without giving totals.

It climbed 16.0 per cent into the US, reaching $3.26 billion.

Ministry officials were unable to explain immediately the huge monthly increase.

Also in the first eight months, FDI was down 1.8 per cent year-on-year to $78.34 billion.

Author

Quick Summary

Associated image

Media

Categories

Primary category

Status

Content Channel

QIC tips growth in Asian issuances

The head of fixed income at QIC expects a rise in Asian issuances led by Chinese corporates, as the risks in traditional US and European markets are seen to be rising.

"High-quality issuances at good credit spreads are increasingly coming up in Asia," said Susan Buckley, managing director of investment manager QIC's Global Fixed Interest business, which runs several hedge funds, among other investments.

"We are looking at [more] Chinese issuances as China looks to liberalise its markets. [The bond market in] Asia is only about half a trillion dollars but is rapidly growing," Ms Buckley told Business Spectator on the sidelines of the AIMA Australia Hedge Fund Forum 2014.

QIC Global Fixed Interest manages about $30 billion for institutional clients, including $1.2 billion in absolute return funds. QIC is the investment arm of the Queensland state government.

Ms Buckley expects credit risks to rise in the US over the next couple of years as more investors chase higher yields.

However, European markets, where real interest rates have turned negative and the European Central Bank has embarked on asset purchases, could see more Australian issuers over the next year.

Many large Australian corporates, including the country’s big banks, have rushed to raise debt in the European market. Last week toll roads operator Transurban said it raised €600 million by way of fixed 10-year notes, while Origin Energy priced a €1 billion issuance of hybrid securities.

Others include Scentre Group, which raised $3 billion in European bonds, and Brambles, which raised €500 million earlier in the year.

"We are not so concerned about Australian companies because these are high-quality names that are issuing," Ms Buckley said.

Brisbane-based QIC, which has offices in London and the US, may look at setting up an office in Hong Kong or Singapore as the Asian market expands, Ms Buckley added.

Author

Quick Summary

Associated image

Media

Categories

Primary category

Status

Content Channel

China injects $90bn into banks

China's central bank is injecting 500 billion yuan ($90bn) into the country's five major state-owned banks as it moves to counter a worse-than-expected slowdown in the world's second-largest economy, according to a senior Chinese banking executive.

The size of the injection, which will be in the form of a three-month, low-interest-rate loan to the banks, is similar to a 0.5-percentage-point cut in the amount of reserves China's commercial banks set aside with the People's Bank of China.

The move shows that Beijing is continuing to use targeted measures--as opposed to a broad-brush stimulus plan--to spur the economy. Officials at the Chinese central bank have been arguing that more drastic easing, such as a cut in interest rates, might cause a flood in lending that would worsen China's debt problems and put the economy at greater risk.

The PBOC will pump 100 billion yuan each into Industrial & Commercial Bank of China, China Construction Bank, Agricultural Bank of China, Bank of China and Bank of Communications via the central bank's standard lending facility, said the banking executive, who was briefed on the decision.

While there are no explicit conditions attached to this targeted lending, the PBOC is expected to guide the big banks to channel credit into areas the government has deemed as important to the economy, such as public housing and private and small businesses, the executive said.

The move follows a raft of disappointing economic data in August that show China's economy is worsening rapidly despite targeted easing and other stimulus measures taken by Beijing early this year.

"We expect Beijing to introduce a slew of other easing and stimulus measures in coming weeks to re-boost confidence and restabilize growth, but the chance of universal rate cuts gets smaller," analysts at Bank of America Merrill Lynch said in a research note.

"We expect short term rates and longer term yield to fall, the economy to benefit, and markets to respond positively to this injection."

Author

Quick Summary

Associated image

Media

Categories

Primary category

Status

Content Channel

China presses on infrastructure bank

China is seeking a commitment from the Australian government next month for its proposed $50 billion Asian infrastructure bank, The Australian Financial Review reports.

Beijing has reportedly secured support from 20 nations for the new bank, with a further 14, including Australia, believed to be weighing support for the scheme, which would rely on capital from member countries.

According to the AFR, China wants to announce a Memorandum of Understanding on the Asian Infrastructure Investment Bank in October but it is unclear if Australia will sign up, as officials are believed to have been taken by surprise with the speed at which the idea has developed.

Government officials are also worried by the prospect the new instutition will undermine the Asian Development Bank and have reportedly sought counsel from more skeptical countries, such as the US and Japan.

Author

Quick Summary

Associated image

Media

Categories

Primary category

Status

Content Channel

A lucrative Chinese opportunity for Australian companies

In a world where consumers and many corporations are deleveraging and smaller companies are becoming more risk averse, where will growth come from?

In Australia there is little doubt what is going to drive our growth: the ballooning Chinese and Asian middle classes. In the US, companies will also target this market but they have sensible energy and flexible labour policies, which are also driving a renaissance in manufacturing.

Australia’s energy policies, particularly in gas, are a mess. But one day that may change and we will be able to follow the US at least part of the way.

There is no segment of the Australian corporate base that isolates ‘supplying the middle class of Asia’, but when you look around it is remarkable the number of Australian companies and industries that are basing their growth on that market.

Let me isolate a number of companies and industries. I am sure readers will think of more:

- Seek is seeking to duplicate its online recruitment strategies in China and other countries, and one day those operations will be bigger than its operations in Australia.

- Crown is expanding its casino base in Australia, particularly Sydney, looking to tap more high net worth Chinese. And of course it has a strong operation in Macau.

- Our apartment development industry in Melbourne and Sydney is building a large number of apartments for Chinese buyers wanting a residence in Australia to diversify their asset base. Both cities are studded with cranes.

- Our dairy industry has been much slower than New Zealand in understanding the potential of the Chinese middle class market, but it is now starting to catch up. Trade Minister Andrew Robb wants to develop northern Australia to meet the demands of the growing Chinese and Asian middle class (The one minister who has a vision for Australia, August 19).

- We are seeing global private equity groups led by KKR move on Treasury Wine Estates, our largest winemaker and the company with the best brands to sell to middle-class China. They are long-term investors who are buying in anticipation of a boom.

- China’s middle class is moving against coal. Our coal industry is in denial and I received a strong reaction when I revealed that Beijing would not use coal to generate power and this would gradually spread through China (Australia’s coming coal firestorm, August 18). The latest restrictions on low-quality coal confirm the drive. But such a strategy in China will require more gas and our LNG exporters are supplying some of that gas. Russia will be the big beneficiary. Better energy efficiency requires more copper, and BHP has an active copper development program in China and South America because it believes copper will be a growth metal. BHP is also looking to accelerate the expansion of Olympic Dam by heap leaching the ore first to remove the uranium and some copper and then the rest of the copper. If the current test plant is successful, BHP will accelerate Olympic Dam’s underground mining development and erect new heap leaching treatment plants there.

- The vast number of tourist facility operators including hotels and bus lines are set to become part of an enormous growth industry.

Step by step, our growth is going to be based around the Chinese middle class.

Status

Media

Type

Companies: ASX Listed

China coal claims 'alarmist', says council

A peak mining body has dismissed suggestions that a Chinese ban on "dirty" coal would devastate Australia's multi-billion dollar exports to the Asian economic powerhouse.

China's powerful National Development and Reform Commission has flagged an import ban on certain low-grade coal from January 1 next year in a bid to tackle crippling smog in its major cities.

There's fears such a move would jeopardise Australia's lucrative coal exports to it's largest trading partner.

But the Minerals Council of Australia has quickly labelled such reports "misleading and unnecessarily alarmist".

The council's executive director Greg Evans said it appeared the proposed ban would only affect brown coal - which Australia does not export - and low quality domestic black coal.

"There is nothing in the information which suggests that Australian coal exporters will be disadvantaged and we are confident that we can meet the proposed specifications," he said in a statement.

The council anticipates demand for Australia's high-quality thermal black coal to remain strong not just from China but other emerging economies.

China is the world's largest consumer of coal, accounting for around half of global consumption.

Figures from the Department of Foreign Affairs and Trade show Australia exported $9 billion worth of coal to China last year.

Author

Quick Summary

Associated image

Media

Categories

Primary category

Status

Content Channel

ICBC to clear yuan transactions

Industrial and Commercial Bank of China (ICBC) has been selected to clear yuan transactions in Luxembourg, which aims to become a major trading centre as China expands use of its currency abroad.

The Luxembourg Central Bank said on Tuesday in a statement it "welcomes the People's Bank of China's selection of Industrial and Commercial Bank of China (ICBC) Luxembourg Branch as the renminbi clearing bank in Luxembourg".

In the past few months China has designated banks in a number of countries to clear transactions in renminbi, or yuan, as it seeks to make it possible for companies and financial institutions abroad to use its currency in cross-border transactions.

Financial transaction firm SWIFT said Luxembourg is in second place behind London for yuan transactions in Europe, and it aims to be one of the top foreign trading hubs for trading in the Chinese currency.

Luxembourg's low tax rates have helped it attract the European headquarters of numerous multinationals.

It already has three Chinese banks operating in the country and another three financial companies plan to set up shop by the end of the year.

China keeps a tight grip on the value of its currency and limits capital flows into and out of the country due to fears they could disrupt the economy, the world's second-largest.

But authorities have moved gradually to liberalise the yuan's movements and allow a more market-oriented exchange rate.

Author

Quick Summary

Associated image

Media

Categories

Primary category

Status

Content Channel

Huawei looks to boost investment in IT infrastructure

After overtaking many Western rivals in the market for telecommunications gear, China's Huawei Technologies Co. is now setting its sights on another big market: servers and data centers.

Huawei aims to boost its revenue from its information-technology infrastructure business--consisting mainly of computer servers, storage and data center management--tenfold to US$10 billion in five years, the company's top executive said Tuesday in an interview.

In China, the company already counts such Internet firms as e-commerce giant Alibaba Group Holding Ltd. and major financial institutions among its customers for products and services related to data centers, which house key computer systems.

Globally, Huawei is still a relatively small player in the data center business dominated by Western competitors like International Business Machines Corp., Hewlett-Packard Co., Cisco Systems Inc. and EMC Corp.

"We will heavily invest in this area," Eric Xu, Huawei's acting chief executive, told The Wall Street Journal in an interview Tuesday.

Huawei boosted its investment in research and development for IT products and services by 20 per cent to US$600 million this year. Next year, it will spend even more, Mr. Xu said, declining to disclose the amount.

Huawei still has a long way to go because supplying servers and helping build data centers require different and broader sales channels compared with how it sells its telecom gear to carriers, analysts say.

IT infrastructure is a small but growing part of Huawei's business. Last year, Huawei generated about 70 per cent of its US$38.9 billion revenue from the telecom carrier network business. While IT products and services only accounted for less than 3%, the segment's revenue rose 60 per cent to US$1 billion, according to Huawei.

In the global data center market, "Huawei is starting from almost zero presence so there is a lot of room for growth," said Forrester Research analyst Bryan Wang. Huawei needs new engines for growth because the telecom equipment market is largely saturated, he said.

Still, Huawei could expand quickly by offering competitive products at lower prices, just like it has done in the telecom market, analysts say.

Mr. Xu said Huawei isn't using lower prices as a primary way to gain market share, but acknowledged that new customers who aren't yet familiar with Huawei's IT offerings often expect better deals.

Huawei is expanding its IT infrastructure business as U.S. competitors have faced challenges in China in part because government agencies and sensitive industries are turning to domestic suppliers, citing security risks of key technologies supplied by foreign companies.

Major banks such as the Bank of China, China Construction Bank and Agricultural Bank of China are using Huawei's servers and storage products in their data centers, according to Huawei.

Huawei sees a "huge market" in the financial-services sector in China--not just banks but insurance firms and brokerages, Mr. Xu said.

He declined to comment on whether government policies are giving Huawei advantages against Western rivals in China, and said Huawei wants China to be an open market.

"If China becomes a closed market, that would be a tragedy for Chinese companies," because lack of foreign competition makes them less motivated to keep improving their products, he said.

Huawei has also provided data-center equipment and services to Alibaba, which is expected to go public this week in the U.S. in an initial public offering that could raise as much as US$25 billion.

Beyond China, Huawei is trying to expand its data center and other IT businesses in Europe by teaming up with German business software company SAP SE.

In the U.S., Huawei has largely been shut out of the telecom networking gear market since a congressional report in 2012 recommended that U.S. carriers avoid equipment from the Chinese supplier out of national security concerns. Huawei denied the allegations.

"The door is still open" for Huawei's server and data center businesses in the U.S., Mr. Xu said.

"In the U.S., we are focusing on less sensitive industries" such as retail and education, said Raymond Lau, a Huawei IT infrastructure unit executive in charge of finding business partners. "The U.S. is never an easy market," he said.

Mr. Xu's interview was during Huawei's two-day cloud-computing conference--an annual event that began four years ago. Shanghai's Expo Center was packed with thousands of enterprise clients and business partners from about 80 countries.

Author

Quick Summary

Associated image

Media

Categories

Primary category

Status

Content Channel

Uighur scholar faces trial in China

When an American scholar came to Jewher Ilham's apartment in January to tell her that her father, a prominent Uighur rights advocate, had been taken from his Beijing home by police, she started to smile. It took a moment, she said, to realize it wasn't joke.

"I knew they might take action against him, but I never thought it would be so fast and so ruthless," the 20-year-old Indiana University student said.

Her father, Ilham Tohti, will stand trial Wednesday on charges of separatism in a case that illustrates the Chinese government's shrinking tolerance of even moderate dissent at a time of increasing ethnic violence between Uighurs, a mostly Muslim ethnic group from the northwestern region of Xinjiang, and the country's dominant Han Chinese.

Separatism, or advocating for cessation from the state, is a serious charge in China that can lead to a prison sentence of anywhere from 15 years to life, sometimes even death. Once formally charged, criminal suspects are almost always found guilty.

Although a staunch critic of China's ethnic policies, Mr. Thoti, a professor at Beijing's Minzu University, had established a reputation as a moderate who advocated for change within the system. He was also among the few prominent figures in China capable of straddling the ethnic divide between Uighurs and Han Chinese, according to many scholars and activists.

"He has connections at every level of Uighur society. At the same time, he's the most important representative of Uighurs among Chinese intellectuals," said Wang Lixiong, a writer and minority-rights activist. "He's truly valuable."

Prosecutors in Xinjiang's capital, Urumqi, where Mr. Tohti is being held, accuse the economist of promoting violence and ethnic hatred with the goal of achieving independence for Xinjiang. According to his lawyers, most of the allegations are connected with Uighur Online, a website that Mr. Tohti started in 2005, which became a source of news about Uighur issues following deadly ethnic riots in Urumqi in 2009.

Mr. Tohti has denied the charges through his lawyers. Phone calls to the Xinjiang prosecutor's office rang unanswered Tuesday. The Urumqi Immediate People's Court, where Mr. Tohti is scheduled to be tried, and the Xinjiang propaganda office didn't respond to requests to comment.

Friends and family say Mr. Tohti was always careful to avoid advocating separatism.

"My father was a realist. He knew that independence for Xinjiang was an unreasonable goal," said Ms. Tohti. "He preferred to concentrate on things that were achievable: employment and protection of human rights."

In the wake of the 2009 Urumqi riots, Mr. Tohti took pains to guard against allegations of separatism or collusion with foreign organizations, according to a long autobiographical essay he wrote in 2011. "I have doggedly refused to take a single cent from foreign organizations, whether diplomatic entities or NGOs, when I encountered financial difficulties resulting from external pressure," he wrote, according to a translation by the website China Change. "Even during business dealings, I was unwilling to make any money through foreign connections."

Mr. Tohti and his family had been subject to surveillance and harassment by authorities in the past, Ms. Tohti said, but it wasn't clear what prompted his detention in January.

Analysts and friends point to an attack two months prior in which an SUV driven by a Uighur family careened through a crowd of tourists before bursting into flames at the entrance to Beijing's Forbidden City. The incident shook authorities and prompted a sweeping antiterrorism campaign.

"Frankly I think that it is highly unlikely that Tohti was involved in anything that could be reasonably defined as separatism," said Michael Clarke, an expert on Xinjiang at Australia's Griffith University. "Rather what his arrest and impending imprisonment demonstrate is the [Communist] Party's renewed hard line on ethnic issues, and on the Xinjiang and Uighur issues in particular."

The concern now, Mr. Clarke and other say, is that Mr. Tohti's conviction could aid the radicalization of Uighurs who might otherwise have taken a more moderate position and undermine government efforts to better integrate Uighurs into Chinese society by enticing them to leave Xinjiang.

In the months since the economist's arrest, assailants identified by the government as coming from Xinjiang have carried out multiple deadly attacks on train stations and government buildings.

"People say Ilham was too sharp with his criticisms. But he only spoke out because he had hope for the system," said Mr. Wang. "It's when people aren't talking that you should be afraid. And that's what's happening now."

Ms. Tohti said she has avoided discussing specifics of her father's case with family members in China out of fear that authorities might respond by cutting off communications. She nevertheless echoed concerns that his treatment could have a magnifying effect on ethnic tensions. "I think this is going to hurt a lot of Uighurs," she said. "Before they had a way to communicate with Han Chinese. Now they don't."

Author

Quick Summary

Associated image

Media

Categories

Primary category

Status

Content Channel

What’s lurking in the shadows of China’s banks

“Shadow” banking: a surprisingly colorful term for our staid economics profession. Intended or not, it conjures images of dark, sinister, and even shady transactions. With a name like “shadow banking” it must be bad. This is unfair. While the profession lacks a uniform definition, the idea is financial intermediation that takes place outside of banks—and this can be good, bad, or otherwise.

Our goal here is to shine a light on shadow banking in China. We at the IMF have used many terms. Last year, we had a descriptive one, albeit a mouthful—off-balance sheet and nonbank financial intermediation. The April 2014 Global Financial Sector Report(GFSR) called it nonbank intermediation. This year our China Article IV report used the term shadow banking.

What’s in a name

“That which we call a rose, by any other name would smell as sweet.” Taking a cue from Shakespeare’s Juliet, let us not worry about the label and instead focus on the facts.

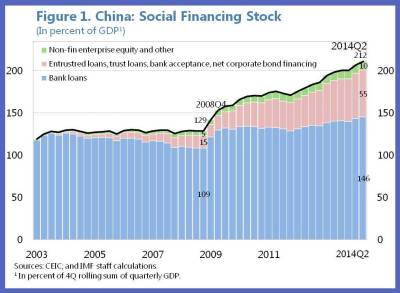

Interest in China’s shadow banking…eh, nonbank intermediation…stems mainly from its rapid growth since the global financial crisis in 2008. This is the pink part in Figure 1 which has more than tripled since 2008, albeit from a low base. It has also accounted for half of the increase in overall credit to the economy or total social financing—even more than bank loans.

In China, shadow banking is often defined as total social financing less bank loans. We tend to exclude equity issuance—firms raising money by selling stock (as this is not credit)—which is the green part in Figure 1. Thus, we focus on the pink part.

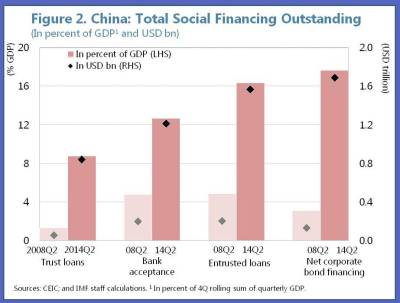

The pink part—that is shadow bank or nonbank intermediation—consists of the four components in Figure 2:

- Corporate bonds. Yes, corporate bonds are the largest component of so-called shadow banking.

- Entrusted loans. These are corporate to corporate loans, administered by a bank. Company A has excess cash, it lends to company B. The bank is just a necessary bookkeeper with no “skin in the game,” but a needed one, since in China’s system, A cannot directly lend to B.

- Bankers’ acceptances. These are letters of guarantee issued by a bank that its customers can use to finance a transaction. These are “undiscounted” as the bank is issuing a guarantee rather than an actual loan. Once “discounted,” this form of credit is recorded in bank loans.

- Trust loans. This is lending by trust companies. Unlike a bank loan, though, on paper the trust company just brings the borrower and investor together for a fee.

Size of China’s Shadow banking

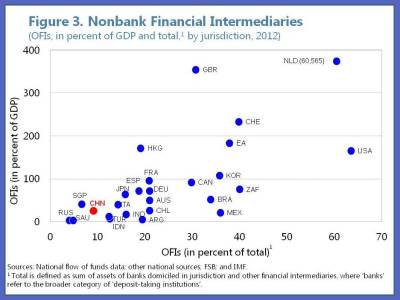

The Financial Stability Board suggests that China’s shadow banking sector is quite small, as in many other emerging market economies. Figure 3 shows that shadow banking in China is relatively low both as a share of GDP and as a share of financial intermediation. But the Financial Stability Board filters out of its estimates those parts of the nonbank financial system that are not formally involved in “credit intermediation.” And there’s the rub. In China, it is often not clear whether shadow banks, such as trusts, really are just loan arrangers or whether they are lending like a bank and taking on credit risk. Reflecting this uncertainty, shadow banking in China could be measured more broadly. Specifically, the pink area in Figure 1 (55 percent of GDP). The forthcoming October Global Financial Stability Report uses an estimate of 35 percent of GDP, as it subtracts corporate bonds (nearly 20 percent of GDP) from the pink area.

Bottom-line: is Shadow Banking a Sweet Smelling Flower or a Thorny Bush?

Both. On the plus side, the expansion of nonbank intermediation marks progress in financial development. It benefits companies by providing alternative ways to borrow. And, it benefits households, by giving them more investment opportunities, which is especially important given the ceiling on deposit interest rates. Therein, however, also lays the thorn.

Shadow banking provides an opportunity to circumvent regulations, such as the deposit interest rate ceiling (but there are many others). For example, rather than putting money in a deposit, a bank’s customer could buy a wealth management product from the bank that offers a higher return. This wealth management product, in turn, may invest in equities and bonds but can also, subject to a limit, invest through shadow banks in assets that look a lot like bank loans.

More broadly, shadow banking moves intermediation outside of formal banking—which has safeguards such as capital requirements, provisions against loan losses, loan to deposit ratios, well-established supervision and regulation—to more uncharted territory. The regulators and supervisors are trying to keep up with this fast-moving sector, with some recent success, but it remains a huge challenge.

At the same time, investors appear to have been largely protected from the inevitable losses that should come with risky lending. It is hard to find a case, for example, of investors in a fixed income trust or wealth management product incurring any losses. This perpetuates the perception that the trust company and/or selling bank, perhaps for reputational reasons, is implicitly guaranteeing the investment. Meanwhile, investors may not appreciate the underlying risk of such products and invest too much of their saving in them.

And, this is just the tip of the iceberg in assessing the benefits, costs, and risks of shadow banking, which is a topic for another day.

The forthcoming October issue of the Global Financial Stability Report will have a broader discussion of shadow banking in China and elsewhere. You can also listen to this recent podcast on shadow banking.

This article first appeared on iMFdirect. Republished with permission.

Status

Media

Type

Dalian Wanda files Hong Kong listing application for its IPO

Dalian Wanda Commercial Properties Co., which is controlled by Chinese billionaire Wang Jianlin, has filed a listing application with the Hong Kong Stock Exchange Tuesday for its initial public offering that could raise between US$5 billion and US$6 billion in the city.

A listing application, or an A-1 filing, is the first step toward getting approval from the Hong Kong exchange for a listing in the city. With the size of over US$5 billion, the IPO could be the biggest offering since Swiss metals trader Glencore International PLC which raised $10 billion in a Hong Kong-London listing in May 2011, according to Dealogic. Dalian Wanda Commercial Properties could be also the largest real-estate firm ever to list in Hong Kong.

Dalian Wanda Commercial Properties is the property arm of Dalian Wanda Group, the Chinese company that bought movie chain AMC Entertainment AMC Holdings in 2012. Dalian Wanda is owned by Mr. Wang who is a former military officer originally from southwest China's Sichuan province. He set up the company's operations in Dalian, a major city in Liaoning province in the northeast of the country.

According to the preliminary prospectus, the property firm has 178 property projects including Wanda Plazas in 112 cities across 29 provinces in China. It recorded 87 billion yuan (US$14 billion) of revenue last year, and 25 billion yuan of net profit.

China International Capital Corp. and HSBC Holdings PLC are joint-sponsors of the offering which could take place by the end of the year.

Author

Quick Summary

Associated image

Media

Categories

Primary category

Status

Content Channel

A chance to mend China–Japan relations

Over the last two years, China–Japan relations have been trapped in a downward spiral. The inescapable reality of an ongoing great power transition makes this situation particularly tense: the size of China’s economy relative to Japan’s jumped from a mere 25 per cent in 2000 to 99 per cent in 2009 and then to 188 per cent in 2013. Yet an alternative policy course is slowly developing.

Should Chinese and Japanese leaders grasp this chance, they could turn the relationship into an economic asset for the demanding reform programs pursued by Japanese Prime Minister Shinzo Abe and Chinese President Xi Jinping.

Following former Japanese prime minister Yasuo Fukuda’s secret meeting with Xi Jinping in Beijing in late July, the foreign ministers of the two countries — Wang Yi and Fumio Kishida — recently met in Myanmar on the sidelines of the ASEAN Regional Forum to discuss Sino–Japanese relations. These meetings have raised expectations of a possible bilateral summit meeting in Beijing on the back of the APEC Leaders’ Summit in November.

Japan and China should grasp this new opportunity.

The tough economic reforms launched by the new Xi regime since 2013 to move China beyond a possible ‘middle-income trap’ stand a greater chance of success with Japanese technology, know-how and support in regional governance.

Japan’s Abenomics reforms have hit both fiscal and structural obstacles. The Trans-Pacific Partnership (TPP) could eventually help incentivise further structural reforms, but progress in the trilateral FTA with China and South Korea as well as further integration with China could support growth more directly. Together, Japan, China and South Korea could play an innovative role in East Asian economic governance and, beyond that, in the G20.

What would it take to move in this direction?

In the decade following the Asian Financial Crisis, a common commitment to economic liberalism and the political will to cooperate boosted the whole Asian economy. As a result, all economies in the region, including the US, benefited from the ASEAN-led process of regional cooperation.

In contrast to these pragmatic times, Japan and China have now openly launched rival integration projects. They are members of competing trade agreements (Japan in the TPP and China-centred FTA networks with regions such as ASEAN, New Zealand, and other around the world). To mark its displeasure with the Japan-controlled Asian Development Bank, China is now planning to establish the Asian Infrastructure Investment Bank later this year. China also played a leading role in the recent BRICS decision to create the Shanghai-based New Development Bank, in part to rival the G7-dominated World Bank and IMF.

Mutual accommodation would allow for a more secure and prosperous way for both countries to jointly contribute to furthering development and boosting trade in the region.

Although the China–Japan–South Korea FTA talks are currently stalled, all three economies are highly interdependent. The trilateral FTA is still officially seen as the top priority FTA by China and it is strongly supported by business groups in Japan.

The recent bad shape of Sino–Japanese relations has as much to do with the growing sense of economic competition as it does with the disputes over territory and history.

As the world’s second and third largest economies, China and Japan find themselves increasingly locked in a tense competition for energy and raw materials, secure shipping lanes and overseas markets — particularly in sectors such as high speed trains, power generation, IT and electronics products. Xi’s active diplomacy with Russia, Africa and Latin America, and Abe’s globetrotting reflect the increasing sense of insecurity over these matters.

Misunderstandings about the intentions of the other side, as well as strong posturing for domestic audiences, has also fuelled tensions. But, if the leaders of China, Japan, and South Korea recognise that their respective top priority reform goals will rise or die together, a new domestic discourse could begin to take hold.

The leaders of Japan and China should grasp the current opportunity to compromise and create an amicable environment at the summit meeting in November. While public opinion in both countries about the other side is abysmal, the publics in both countries support a summit (65 per cent in Japan, 53 per cent in China) and more management of the relationship.

As an important step, Abe should avoid visiting the Yasukuni Shrine. Ideally Japan should develop a long-term arrangement where leaders and citizens alike praying for the souls of Japanese soldiers who died for their nation can be separated from tacit support for the 14 Class-A war criminals, enshrined at Yasukuni, and the Yushukan Museum.

A practical arrangement on another key issue, the disputed Diaoyu/Senkaku islands, is also needed. Japan and China could return to the 1972 understanding to peacefully shelve the issue for future generations to resolve. This should be supported urgently by developing communication protocols among coast guards and practical ways of dealing with possible fishing incidents, along the lines of a presumed 2005 secret agreement . Such simple moves would enable both sides to deescalate the risks of naval and aerial confrontation.

These ideas may seem unrealistic in the current domestic environments of both China and Japan, but there is reason to be cautiously optimistic. For the first time in more than 10 years, both China and Japan have strong and secure political leaders at the same time. Should they choose to work together and focus on their common interests, they could usher in a new win-win relationship from which the region, and the world, would immensely benefit. It is high time to step back from the brink and prepare for a path-breaking summit in November.

Yves Tiberghien is Director of the Institute of Asian Research and Associate Professor of Political Science at the University of British Columbia

Yong Wang is Professor and Director of the Center for International Political Economy in the School of International Studies at Peking University

This article originally appeared on the East Asia Forum. Republished with permission.

Status

Media

Type

Asia billionaires in fastest wealth growth

Asia's billionaires led by Chinese tycoons enjoyed the fastest increase in their wealth this year compared to their peers in the rest of the world, a report says.

The combined wealth of Asia's billionaires grew 18.7 per cent from last year to $US1.41 trillion ($A1.53 trillion), said the report by Wealth-X, a research firm specialising in ultra-high net worth individuals, and Swiss bank UBS.

Asia added 52 new US-dollar billionaires so far this year, bringing the region's total to 560, with China accounting for 33, or 63.5 per cent, of the new entrants to the exclusive club.

Although Asia was in third place behind Europe and North America in terms of the total number of billionaires, those from Asia recorded the fastest growth in wealth of any region in the world.

Asia accounted for 30 per cent of the net increase in global billionaire wealth in 2014, the report said.

It said the number of billionaires worldwide rose 7.0 per cent from the previous year to a record 2,325 - an increase of 155.

Their combined wealth reached $7.3 trillion, up 12 per cent.

Europe topped the rankings with 775 billionaires, followed by North America with 609, while the Middle East with 154 billionaires came in fourth place behind Asia.

"The rise of Asia as a global economic powerhouse has already started, and the performance of the region's billionaires illustrates just how strong the region is and how many opportunities for wealth accumulation it offers," the report said.

Most of Asia's billionaires made their fortune from within the region mainly from real estate and industrial conglomerates.

Only 11 per cent of them have amassed their wealth through finance, banking and investment, a percentage "much lower than in other regions," the report added.

Asian billionaires are also the youngest worldwide, with the average age at 61, with only 13 per cent having fully inherited their wealth.

Within Asia, China has the most number of billionaires at 190, followed by India (100), Hong Kong (82), Japan (33) and Singapore (32).

Taiwan was in sixth place with 29, followed by South Korea (21), Indonesia (19) and Thailand (17). The Philippines rounded up Asia's top 10 with 13 billionaires.

Relative to population, Hong Kong topped the list in Asia with 11.2 billionaires per one million people, followed by Singapore with 5.8 billionaires per one million people, the report said.

Hong Kong and Singapore were ranked fourth and sixth, respectively, worldwide in terms of the number of billionaires relative to population.

Author

Quick Summary

Associated image

Media

Categories

Primary category

Status

Content Channel

Markets cheer China stimulus report

A reported $US81 billion ($A87.6 billion) injection into China's major banks is the first of a series of expected stimulus measures by Beijing to boost the world's second largest economy, analysts say.

Online portal Sina late on Tuesday quoted financial institutions as saying the People's Bank of China (PBoC), the central bank, would channel 500 billion yuan ($US81 billion) into the country's five biggest banks. The PBoC has not confirmed the move.

"We believe Beijing (is) to introduce a slew of other easing and stimulus measures in coming weeks to re-boost confidence and re-stabilise growth," Bank of America Merrill Lynch said in a research note.

Hong Kong stocks rallied more than one per cent in the first few minutes of trading on Wednesday following the report, although China markets were largely unmoved with the benchmark Shanghai Composite Index up only 0.20 per cent by mid-morning.

US stocks reacted to the report strongly, with the Dow Jones Industrial Average rising 0.59 per cent to 17,131.97 points and the broad-based S&P 500 up 0.75 per cent at 1,998.98.

The Industrial and Commercial Bank of China, Bank of China, China Construction Bank, Agricultural Bank of China and Bank of Communications will receive the funds over three months through the central bank's so-called Standing Lending Facility, a tool it uses to manage short-term liquidity, Sina and analysts said.

The report follows a string of weak data for August, including a five-year low for industrial output growth and a surprise drop in imports, which have put in peril the government's target of 7.5 per cent annual economic expansion for this year.

Analysts said the scale of the injection was equivalent a 0.50 percentage point cut in the reserve requirements for banks, the amount of funds they are required to hold aside.

Author

Quick Summary

Associated image

Media

Categories

Primary category

Status

Content Channel

Xi kicks off Sri Lanka port development

Chinese President Xi Jinping has launched the construction of a $US1.4 billion ($A1.5 billion) port city in Sri Lanka's capital that will give Beijing a firmer foothold in the Indian Ocean region.

Xi wrapped up his two-day visit to Sri Lanka by visiting Colombo harbour to kick off building of the port city, before heading to neighbouring giant India.

The new city, Sri Lanka's largest single foreign investment, is being built alongside an already existing Chinese-built container terminal, the only mega port in South Asia.

As part of the deal with Sri Lanka, China will gain ownership of one third of the total 233 hectares of reclaimed land that the new port city will occupy.

Sri Lanka is a midway point on one of the world's busiest international shipping lanes that Beijing wants to secure as a maritime silk road of the 21st century.

Colombo hopes the city, which will have a Formula One track and a luxury marina, will attract another $US5 billion in foreign investment for property development.

Late on Tuesday, Xi and Sri Lankan President Mahinda Rajapakse announced increased defence and maritime security ties and pledged to deepen their "strategic co-operative partnership".

On the first day of his visit, Xi launched Sri Lanka's biggest electricity generator, a Chinese-funded $US1.3 billion 900-megawatt coal power plant located less than 200km from India.

China's huge investments in Sri Lanka and other South Asian nations, in India's neighbourhood, have caused unease in New Delhi.

Some officials in New Delhi have voiced fears in the past that China's growing engagement in the region is a deliberate strategy to encircle India.

Author

Quick Summary

Associated image

Media

Categories

Primary category

Status

Content Channel

Shanghai leads the way in reform of state enterprises

Shanghai is positioning itself at the forefront of China's campaign to reform state-owned enterprises by inviting private investment in the city's companies and encouraging stock-incentive plans for managers.

Improving the performance of the country's shambling state sector is a key goal for China's new leadership, which laid out its plans in a major blueprint last November. Shanghai was the first local government to release its reform guidelines late last year and the city has already seen a number of private-equity funds invest in its government-owned companies.

In the most recent high-profile deal, Shanghai Jin Jiang International Hotels said last month that it received the city's approval to sell a 12.4 per cent stake for 3 billion yuan ($488 million) to Chinese private-equity group Hony Capital. The hotel group is one of China's biggest and is set to operate a hotel in the country's tallest skyscraper when it opens next year in Shanghai's financial district.

As Shanghai sells stakes in its local enterprises, bigger deals are taking place on a national level. China Petroleum & Chemical Corp., or Sinopec, earlier this month said it would sell nearly 30 per cent of its sales and marketing unit to 25 investors for US$17.5 billion -- a notable injection of private capital into China's largest oil refiner.

For Shanghai, the central government is looking for it to live up to its billing as a financial and commercial hub. The city is also developing a free-trade zone designed to drive a remaking of the country's financial system. Next month, a new program will link stock markets in Hong Kong and Shanghai, allowing international investors further access to China's largely closed off equities.

"Shanghai in many cases has led the economic experiments in China," said Tai Hui, chief market strategist for Asia at J.P. Morgan Asset Management. "So if SOEs are starting to partner with private equity, to me it sounds like it is going to be broadened out to the rest of the country."

Analysts say investment from private equity can improve the efficiency of state-owned companies because outside investors are more likely to make changes that will yield higher returns, and will be less influenced by government objectives such as high employment and steady economic growth. Still, because they have taken minority stakes private partners' influence on how a company is run will be limited.

Hony, which is also paying 1.8 billion yuan for a 10 per cent stake in state-owned property developer and wastewater-management company Shanghai Chengtou Holding Co., has been working to restructure state assets since its founding more than a decade ago.

The firm is now doing "bigger, more significant deals" with state-owned enterprises, said Chief Executive John Zhao. With Jinjiang, he said, the priority will be helping the company put in place "market-driven governance" measures, including employee incentive programs.

There are other signs of change. Government-controlled Bright Food Group, which bought U.K. cereal maker Weetabix Food Co. two years ago, says half of its subsidiaries are now owned partly by private investors. In February, Hong Kong-based private-equity firm RRJ Capital said it will invest 1.5 billion yuan into Shanghai Bright Holstan, a dairy farming joint venture with Bright Dairy & Food, a subsidiary of Chinese conglomerate Bright Food Group.

Bright Food has also implemented a stock-incentive scheme in its subsidiaries that covers senior and mid-level management, and which is typically based on three-year performance targets.

Further deals could be slow in coming, though. Investors say Shanghai's state-owned enterprises are better run than their peers in other parts of the country. As a result, there is little need for external capital, leaving investment opportunities in the city hard to find. "The government officials are fairly capable," said Eric Xin, senior managing director of Citic Capital's private-equity arm in China. "There's not an incentive to sell off SOEs."

Signs of progress in Shanghai are significant because it is a hotbed of state-owned companies. Its state-owned assets account for 60.1 per cent of gross domestic product, the second-most among China's provinces and municipalities, according to research from Credit Suisse. All but one of the city's 20 largest companies that are listed on the domestic stock market are controlled by the government, according to data from ChinaScope Financial.

The city's big state-owned companies include major industrial firms such as SAIC Motor Corp., China's largest auto group by sales, and Baoshan Iron & Steel Ltd., or Baosteel, one of the country's biggest steel producers. In August, a partnership was announced between Shanghai Baosteel Gases Ltd. and private-equity firm Warburg Pincus LLC to work together on industrial gas projects.

Author

Quick Summary

Associated image

Media

Categories

Primary category

Status

Content Channel

Xi arrives in India as troops face off at border

Indian and Chinese security forces were locked in a confrontation on their countries' disputed border Wednesday as China's president arrived in India on a trip aimed at boosting economic ties between the two Asian giants.

In the Himalayan region of Ladakh, Indian troops faced off against Chinese soldiers who last week began building a road in an area that India regards as its territory, an Indian official said.

Friction along the two nations' 2,200-mile-long border, much of which is undefined and contested, has mounted in recent years, India says. And it poses a serious hurdle to improving relations between Delhi and Beijing.

On Wednesday, however, the two sides seemed intent on deepening trade and investment links despite significant strategic misgivings, such as India's unease at China's increased Indian Ocean presence, and Beijing's concerns about India's growing ties with Japan and the U.S.

Chinese President Xi Jinping and Indian Prime Minister Narendra Modi met and signed a multibillion-dollar agreement for Chinese investment in an industrial park in Mr. Modi's home state of Gujarat. Indian and Chinese companies signed US$3.43 billion in deals.

On the first day of Mr. Xi's three-day visit, the two leaders talked, walked and watched folk dancing in a riverfront park in the western city of Ahmedabad. Mr. Xi donned an Indian-style vest.

In an op-ed published in the Hindu newspaper Wednesday, Mr. Xi wrote that China and India "have worked together to maintain peace and tranquility in the border area" and that the two nations "need to become cooperation partners spearheading growth" in Asia.

Mr. Modi is eager to win Chinese investment to help fund his efforts to improve India's infrastructure, build a manufacturing base and expand the country's economy.

The boundary disputes will demand a tricky balancing act from the Indian leader as he opens India's doors to Chinese money, analysts say. Mr. Modi has vowed to be tough on security issues and criticized the previous Indian government for being weak.

Mr. Modi hasn't made a direct comment on recent border incidents, though on a trip to Japan he took a swipe at China, saying some countries have an "expansionist mind-set" that leads to "encroaching on another country, intruding in others' waters."

India's Defense Ministry declined to comment on alleged incursions by Chinese soldiers in the border area. Chinese officials in Beijing didn't immediately respond to requests to comment.

Indian army spokesman Rohan Anand said Indian and Chinese officers met on Monday to "discuss border issues." He added: "There is nothing alarming as such."

The standoff over the Chinese road-building effort wasn't the only confrontation this week in the northern border area. Indian authorities said Monday that Chinese civilians and soldiers had disrupted construction of a canal on the Indian side, raising banners that said, "This is Chinese territory."

India's government said last month that the number of Chinese "transgressions" along the border had reached 334 between the start of the year and August. There were 411 such alleged violations in 2013 and 426 in 2012, up from 213 in 2011.

At the heart of the border dispute are two competing claims. India says China occupies nearly 15,000 square miles of its territory on the Aksai Chin plateau in the western Himalayas. China claims more than 34,000 square miles in the east, which Beijing refers to as South Tibet.

The two nations fought a war over the disputed territory in 1962. And several rounds of recent talks to settle the issue have produced few results.

Last year, shortly before Chinese Prime Minister Li Keqiang's visit to New Delhi, Indian authorities accused Chinese troops of pitching tents inside India's territory in a remote region of Ladakh, leading to a three-week standoff.

Part of the problem, Indian officials say, is that India and China have "differing perceptions" of their de facto border, known as the Line of Actual Control. Both sides patrol up to their respective perceptions of the border, leading to frequent claims of transgressions.

Indian analysts argue that Chinese intrusions are a tactic to keep Indian armed forces under pressure and to grab more territory by slowly altering the border.

Srikanth Kondapalli, a professor of Chinese studies at New Delhi's Jawaharlal Nehru University, said that five years ago, the site of one of this week's confrontations, Chumur, was clearly on the Indian side. Chinese troops never sent patrols to this area, he said.

"But it is now part of what is called China's 'extended claim' area," Mr. Kondapalli said.

Foreign affairs analyst Brahma Chellaney calls China's strategy "salami slicing," by which he says Beijing makes small, incremental encroachments into India's territory that don't escalate into war but, put together, give Beijing a strategic advantage.

India has also grown wary of Beijing's growing activities in other parts of South Asia. Before flying to India, Mr. Xi visited Sri Lanka, where China has in recent years financed a number of infrastructure projects, including a port. Mr. Xi launched a new port city project on his trip.

In response, Mr. Modi has moved to reinvigorate India's relationships with its neighbors and it is building stronger strategic ties with countries like Japan and Vietnam to counter China's growing influence.

New Delhi agreed with Vietnam this week to expand cooperation in oil and gas exploration in the contested waters of the South China Sea, prompting a warning from China that no deals should infringe on its territorial claims.

Author

Quick Summary

Associated image

Media

Categories

Primary category

Status

Content Channel

PBOC struggles as Chinese borrowers hold back

China's central bank so far has failed to lift the world's second-largest economy out of its doldrums, and that is in part because of businesspeople like Li Jun.

Mr. Li runs a fish-farming business in eastern China's Jiangsu province. The People's Bank of China is pushing the country's big, state-owned banks to lend more money to businesses like his. Instead of taking the cash, Mr. Li is cutting back.

"Banks are willing to lend to me, but I'm borrowing less because I'm not expanding my business that much," said Mr. Li, chairman of Jiangsu Haihao Agriculture Development Co. "The market is not looking good, which makes me more cautious."

The central bank this week is injecting 500 billion yuan (US$81 billion) into China's five major state-owned banks, according to a senior banking executive briefed on the decision. The move -- which is expected to channel money to areas the government deems important, such as public housing and small business -- marks the latest of a series of targeted easing measures meant to arrest a slowdown in China's economic growth.

Results from many of these efforts have yet to show up in economic data. Economists and analysts say some of the difficulty stems from the traditional reluctance of China's big banks to lend to small business -- a hesitance that is increasing as economic growth slows and the prospect of soured loans increases.

But they also say a lack of real demand for loans, rather than a shortage of credit, is holding the economy back. That explains a recent drop in the rate of overall credit expansion in China despite the PBOC's efforts, and shows the limited power the central bank has in getting the economy going.

"There's plenty of money. People just don't want to use it," said Derek Scissors, a resident scholar at the American Enterprise Institute, a Washington-based think tank. "Dumping yet more money in isn't going to change that."

Central bank officials didn't respond to requests for comment.

Stock markets in Hong Kong and Shanghai ended higher on Wednesday, responding to news of the central bank's move. The Chinese yuan reversed a weakening streak against the U.S. dollar, and yields on 10-year government bonds fell.

In terms of injecting money into the financial system, the latest step was roughly equivalent to slashing the percentage of deposits banks must hold as reserves at the central bank by half a point. In the past, the central bank has used such reductions to spur growth across the economy.

Now, though, the bank is aiming its stimulus more narrowly -- a strategy meant to avoid a massive lending spree such as the one that propped up growth following the 2008 global financial crisis, but also saddled the economy with debt. Other initiatives have included a three-year, 1 trillion yuan loan to China Development Bank, a so-called policy lender that backs housing and other government projects, plus measures to encourage more lending to private businesses and rural areas.

Despite those efforts, credit growth in China has been sluggish. New lending by Chinese banks jumped in August from July but was still below year-earlier levels. Meanwhile, in July and August, overall new lending -- as represented by total social financing, a broad measure of credit extended by both banks and other financial institutions -- was roughly half the level of last year.

A lending index in the city of Wenzhou, a place famous for its entrepreneurs that is seen as a bellwether for both small businesses and China's informal lending system, showed interest rates have been flat since last year. Rates would have fallen had the easing efforts been more successful.

The numbers come amid signs of weakened domestic demand: Imports have been sluggish, and the property market is slumping. Economists also say Beijing's two-year anticorruption campaign is casting a chill over consumption and investment.

Many Chinese companies appear less eager to spend. At PetroChina Co., the U.S.- and Hong Kong-listed arm of China National Petroleum Corp., capital expenditures fell 15.8 per cent during the first half of the year, compared with a year earlier. The company's profit during the period rose 4 per cent to 68.1 billion yuan.

At China's largest refiner, China Petroleum & Chemical Corp., known as Sinopec, capital expenditures also fell, led by spending slowdowns in its exploration-and-production and marketing-and-distribution segments.

Despite the PBOC's efforts to make credit more available, some private businesses still complain about the difficulty in getting financing, an indication that China's big banks may remain reluctant to lend for fear of bad loans.

"We never get loans from domestic banks as we are a private, asset-light company," said Gu Wu, president of HK (Shenzhen) Industries Development Co., a maker of electronic products based in the southern boomtown of Shenzhen. "We have no plant, no land, so no any domestic banks would like to lend money to us, even as the central government wants to offer support to us."

Mr. Li, the owner of the fish-farming business in Jiangsu, said in the past few years, he used to borrow between 200 million yuan and 300 million yuan a year from banks as he built up his business. But so far this year, he has borrowed less than 100 million yuan.

"You have to pay 20 per cent higher than the benchmark rate for a bank loan these days, versus about 10 per cent last year," he said. "I don't want to be a slave to banks."

For now, economists expect the central bank to resist calls to take more dramatic moves, such as lowering interest rates. So far, the PBOC has fended off calls to broadly loosen monetary policy, fearing such a move would worsen China's debt problems and put the economy at greater risk.

Since early last year, when President Xi Jinping gave Gov. Zhou Xiaochuan a third term at the helm of the central bank, the PBOC has seen its influence on economic matters grow. Mr. Zhou has long championed changes intended to spur competition among state-owned banks and put more money in consumers' pockets, two long-term goals embraced by China's top leaders.

"A rate cut is probably not imminent, though we continue to believe one is likely by year end," said Wang Tao, China economist at UBS AG.